فهرست عناوین

Ask a question about your financial situation providing as much detail as possible. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Which of these is most important for your financial advisor to have?

The time value of money is the main concept of the discounted cash flow model, which better determines the value of an investment as it seeks to determine the present value of future cash flows. The company may accept a new investment if its ARR higher than a certain level, usually known as the hurdle rate which already approved by top management and shareholders. It aims to ensure that new projects will increase shareholders’ wealth for sustainable growth. Calculate the denominator Look in the question to see which definition of investment is to be used.

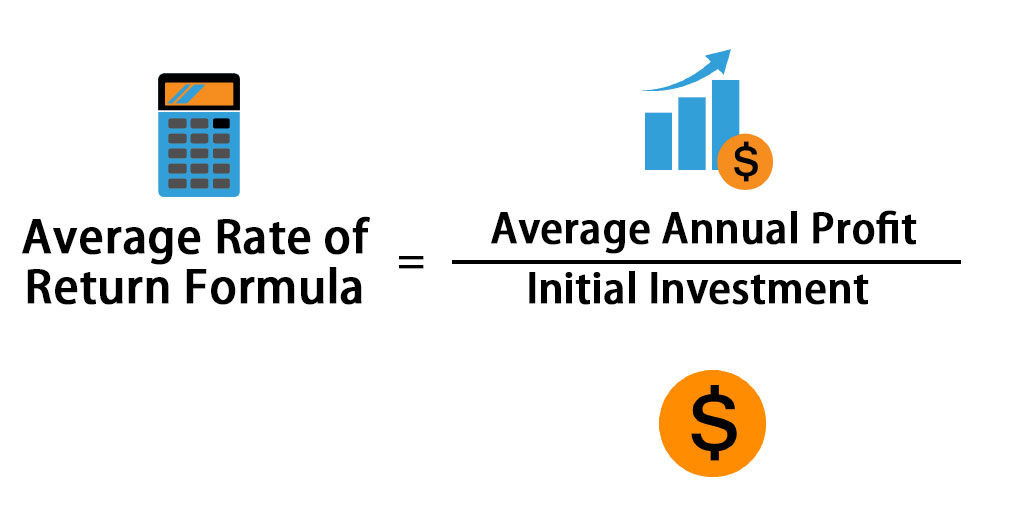

- The accounting rate of return (ARR) formula divides an asset’s average revenue by the company’s initial investment to derive the ratio or return generated from the net income of the proposed capital investment.

- The Accounting Rate of Return (ARR) provides firms with a straight-forward way to evaluate an investment’s profitability over time.

- Accounting Rate of Return helps companies see how well a project is going in terms of profitability while taking into account returns on investments over a certain period.

- This indicates that for every $1 invested in the equipment, the corporation can anticipate to earn a 20 cent yearly return relative to the initial expenditure.

Define (RoR) in Simple Terms

As well as to assist in making acquisition or average investment decisions. The Accounting Rate of Return formula is straight-forward, making it easily accessible for all finance professionals. It is computed simply by dividing the average annual profit gained from an investment by the initial cost of the investment and expressing the result in percentage. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. As we can see from this, the accounting rate of return, unlike investment appraisal methods such as net present value, considers profits, not cash flows.

Discover Wealth Management Solutions Near You

This is when it is compared to the initial average capital cost of the investment. In today’s fast-paced corporate world, using technology to expedite financial procedures and make better decisions is critical. HighRadius provides cutting-edge solutions that enable finance professionals to streamline corporate operations, reduce risks, and generate long-term growth. According to accounting rate of return method, the Fine Clothing Factory should purchases the machine because its estimated accounting rate of return is 17.14% which is greater than the management’s desired rate of return of 15%. Candidates need to be able to calculate the accounting rate of return, and assess its usefulness as an investment appraisal method.

The accounting rate of return is a capital budgeting metric to calculate an investment’s profitability. Businesses use ARR to compare multiple projects to determine each endeavor’s expected rate of return or to help decide on an investment or an acquisition. To find this, the profit for the whole project needs to be calculated, which is then divided by the number of years for which the project is running (in this case five years). Since ARR is based solely on accounting profits, ignoring the time value of money, it may not accurately project a particular investment’s true profitability or actual economic value. In addition, ARR does not account for the cash flow timing, which is a critical component of gauging financial sustainability. The accounting rate of return (ARR) is a formula that shows the percentage rate of return that is expected on an asset or investment.

Would you prefer to work with a financial professional remotely or in-person?

Calculating the rate of return gets the percentage change from the beginning of the period to the end. Remember that you may need to change these details depending on the specifics of your project. Overall, however, this is a simple and efficient method for anyone who wants to learn how to calculate Accounting Rate of Return in Excel.

While it can be used to swiftly determine an investment’s profitability, ARR has certain limitations. The calculation of ARR requires finding the average profit and average book values over the investment period. Whereas average profit is fairly simple to calculate, there are several ways to calculate the average book value of investment. However, it is preferable to evaluate investments based on theoretically superior appraisal methods such as NPV and IRR due to the limitations of ARR discussed below. Based on the below information, you are required to calculate the 23 of the best accounting events to attend in 2020, assuming a 20% tax rate. This is a solid tool for evaluating financial performance and it can be applied across multiple industries and businesses that take on projects with varying degrees of risk.

Further management uses a guideline such as if the accounting rate of return is more significant than their required quality, then the project might be accepted else not. Accounting Rates of Return are one of the most common tools used to determine an investment’s profitability. It can be used in many industries and businesses, including non-profits and governmental agencies. The RRR can vary between investors as they each have a different tolerance for risk. For example, a risk-averse investor requires a higher rate of return to compensate for any risk from the investment. Investors and businesses may use multiple financial metrics like ARR and RRR to determine if an investment would be worthwhile based on risk tolerance.

An ARR of 10% for example means that the investment would generate an average of 10% annual accounting profit over the investment period based on the average investment. Accounting Rate of Return formula is used in capital budgeting projects and can be used to filter out when there are multiple projects, and only one or a few can be selected. They are now looking for new investments in some new techniques to replace its current malfunctioning one. The new machine will cost them around $5,200,000, and by investing in this, it would increase their annual revenue or annual sales by $900,000. Specialized staff would be required whose estimated wages would be $300,000 annually.

فارسی

فارسی

بدون دیدگاه